SoundHound (NASDAQ: SOUN) stock is a perfect example of the fact that there is more than one way to utilize the ongoing artificial intelligence (AI) rally, as the company provides generative AI soundovers for various businesses.

SOUN stock surged almost 20% after it announced on August 8 an $80 million acquisition of Amelia enterprise, enabling it to diversify its base of customers and expand its reach across multiple industries, with most notable examples of central banks and Fortune 500 companies.

In its most recent quarterly earnings report on August 8, SoundHound revealed a double beat on its earning estimates. Revenue of $11.6 million exceeded the projected $10.1 million, setting a full-year revenue forecast between $65 million and $77 million. The adjusted loss for Q1 was 7 cents per share, better than the 9-cent loss analysts had predicted.

However, the company reported a larger GAAP revenue loss than in the previous year, which may have prompted a 6.53%% decline in the latest trading session on August 9.

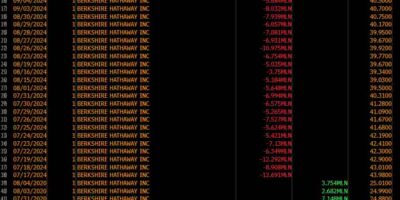

SOUN stock 5-day price chart. Source: Google Finance

Wall Street believes the newest acquisition by SoundHound is a positive catalyst

In addition to a strong Q2 report, Wall Street analysts were optimistic about SoundHound’s most recent acquisition as they saw it as a positive catalyst attesting to the company’s strive to increase its market share.

On August 9, Cantor Fitzgerald upgraded SoundHound to an “overweight” rating and raised the price target from $5 to $7. According to analyst Brett Knoblauch, management has also raised its 2024 revenue guidance to “at least” $80 million and introduced a 2025 target of $150 million, primarily driven by the recent acquisition of Amelia, an enterprise AI software company.

Knoblauch highlights the potential transformative impact of the Amelia acquisition on SoundHound, noting three key advantages: access to a high-profile customer base, including central banks and Fortune 500 companies; a significant stream of recurring revenue, with SOUN expecting $45 million in annual recurring revenue (ARR) by 2025; and an expanded sales force to address strong market demand.

On the same date, Wedbush’s Dan Ives reiterated its “outperform” rating while maintaining a $9 price target. Ives also sees a great opportunity in the company’s newest acquisition, which will, in return, broaden its access to multiple sectors.

In a least optimistic prediction, on August 9, Michael Latimore of Northland Securities reiterated a “hold” rating on SoundHound shares while increasing a price target from $5.50 to $6.

SoundHound CEO believes AI is “magical”

In his most recent interview on August 11, SoundHound’s CEO, Keyvan Mohajer, expressed his excitement about the prospects of AI, which will help industries reach the next level, allowing them to extend their infrastructure and profit margins.

Mohajer said, “As someone who’s been in this field for over 20 years, I can tell you that the technology of generative AI is real. It’s magical. And it’s going to change a lot of things.”

The CEO expressed the vast potential AI brings to the industry, setting the groundwork for companies from various branches to expand their operations and adopt innovative approaches, naming SoundHound as one example.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

The post Wall Street sets SoundHound stock price for the next 12 months appeared first on Finbold.