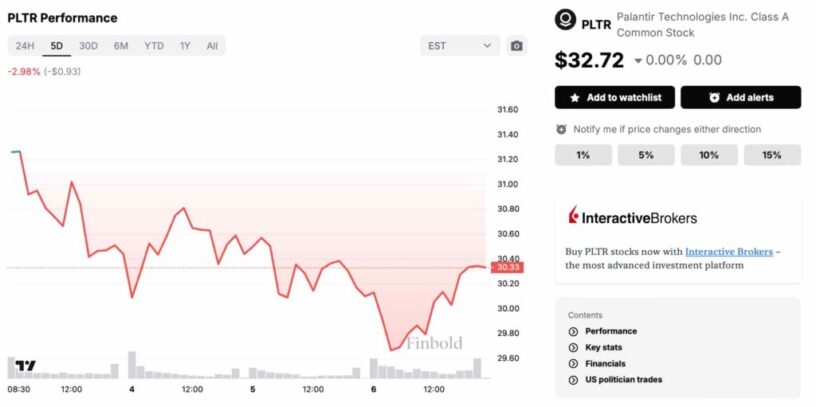

Palantir Technologies (NYSE: PLTR) closed the previous trading session on September 6 at $30.33, registering a slight but notable increase of +0.17 (0.56%) for the day.

However, the real momentum appears to be building in pre-market trading on September 9, where Palantir has surged to $32.72, reflecting a significant jump of over 6%.

Palantir 5-day stock price chart. Source: Finbold

In light of Palantir’s scheduled inclusion in the S&P 500, which is set to take place on September 23 as part of the index’s quarterly rebalancing, there is now strong investor enthusiasm and anticipation with the milestone widely viewed as a major validation for the company.

Add into the mix that Palantir and bp (NYSE:BP) announced today an enterprise agreement that will extend their strategic relationship and introduce new artificial intelligence (AI) capabilities with Palantir’s AIP software.

A look at Palantir’s recent performance

Palantir, recognized as a leader in artificial intelligence and machine learning, has been on an incredible run. Since January 2023, its stock has soared by 370%, riding the wave of excitement surrounding generative AI, fueled by innovations like ChatGPT-4o developed by OpenAI.

With a market cap of around $68 billion, Palantir’s gains have solidified its position as one of 2024’s top performers, delivering an 82.93% year-to-date return even before today’s pre-market rally.

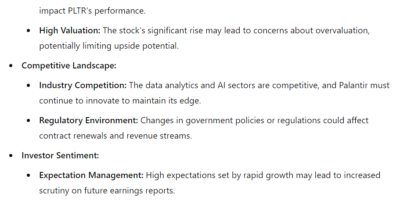

However, despite these substantial gains, Palantir’s valuation is currently eye-popping, trading at 100 times adjusted earnings. This lofty multiple has caused concern among some analysts who question whether the stock can maintain such an elevated valuation.

Wall Street’s Palantir stock outlook

Wall Street analysts remain divided on Palantir’s outlook. Based on 14 analysts’ forecasts over the past three months, the average 12-month price target for Palantir is $25.42, which represents a -16.19% downside from its current price of $30.33.

The highest target sits at $38.00, suggesting potential upside for bullish investors, while the most bearish analyst predicts a steep drop to $9.00.

PLTR stock 12 month forecast. Source: TipRanks

The sentiment on the Street is mixed, with 3 analysts rating the stock as a “Buy,” 5 maintaining a “Hold,” and 6 recommending a “Sell.” This disparity reflects uncertainty over whether Palantir’s high valuation can be justified amid rising competition and market expectations.

PLTR stock technicals

In the past month, PLTR has traded within a wide range, between $29.10 and $33.13 with shares now at the upper end of this range. Notably, the stock is also trading in the upper part of its 52-week range, indicating strong overall performance that mirrors the broader S&P 500, which is also trading near its highs.

From a technical analysis perspective, Palantir’s recent price action has produced a bullish Pocket Pivot signal, which occurs when price movement is accompanied by volume higher than the largest down-volume day over the previous 10 days.

For traders, this is a positive sign, signaling potential accumulation in the stock as investors continue to bet on Palantir’s growth prospects.

Looking closer, PLTR stock is navigating a key support zone between $30.16 and $30.32, an area formed by several trend lines across multiple timeframes.

Resistance is likely to kick in between $32.08 and $32.54, with the next test being whether the stock can push through these levels to establish new highs.

Palantir stock outlook

As Palantir prepares to join the S&P 500, the stock faces a pivotal moment. While its leadership in AI and machine learning positions it well for long-term growth, the stock’s rich valuation and mixed analyst sentiment suggest that investors should be cautious in the near term.

The key for Palantir will be delivering consistent earnings growth and operational performance to justify its premium price.

For investors, the decision hinges on how much risk they are willing to take.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

The post Wall Street sets Palantir (PLTR) stock price for next 12 months appeared first on Finbold.