As more United States Congress members continue to be involved in the stock market, their trading patterns are increasingly eliciting suspicion.

Representative Suzan Delbene from Washington’s 1st congressional district is the latest lawmaker to be caught in the wave of suspicious trading.

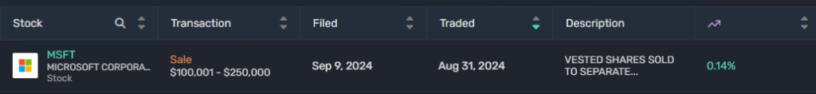

Particulars of the trade provided by Congress trading tracking platform Quiver Quantitative indicate that the lawmaker continued her selling spree of the technology giant Microsoft (NASDAQ: MSFT), offloading shares ranging between $100,0001 and $250,000 on August 31.

The trade filed on September 9 indicated that the politician sold vested equities in the company to a different trust. Notably, the sale proceeds are categorized as not beneficial to Delbene or her spouse.

Rep. Delbene MSFT stock sale. Source: Quiver Quantitative

Also, according to a historical trading activity review, the congresswoman has offloaded MSFT shares worth approximately $33 million over the past three years.

Suspicion around MSFT trade

Indeed, the suspicion arises from the fact that the politician’s husband, Kurt DelBene, was a Microsoft executive who reportedly received significant MSFT stock in compensation. Delbene also represents the district where Microsoft is headquartered.

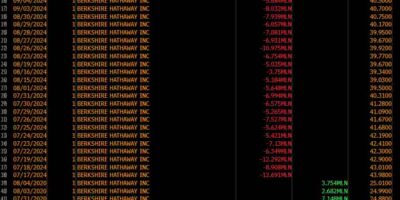

Interestingly, since Delbene was elected to office in 2012, Microsoft’s stock has rallied by about 1,300%. Additionally, after her latest sale, Microsoft stock plunged by a modest 0.9%, trading at $405 at the last close of the market on September 9.

Rep. Delbene MSFT stock performamce after sale. Source: Quiver Quantitative

In the meantime, data indicates that Delbene is among the most active Congress stock traders, with her activity accounting for a whopping volume of $314.68 million. As of September 9, she had initiated 709 trades, with information technology accounting for the largest share.

Rep. Delbene MSFT stock trading summary. Source: Quiver Quantitative

The ethical dilemma

Based on the MSFT transaction, some market participants have pointed out that the structure of the sale and the politician’s relations raise questions about prohibiting Congress stock trading.

Notably, the dilemma for enacting such a ban arises from the questions regarding how the law would be structured to prevent conflicts of interest without unfairly penalizing spouses of corporate executives.

Therefore, the complexity emerges from striking a balance between promoting transparency and ethical behavior in Congress while respecting the rights of individuals who may be only indirectly involved in government.

It is worth noting that the law allows United States lawmakers to engage in stock trading responsibly and transparently. This participation is guided by the Stop Trading on Congressional Knowledge (STOCK) Act, which bars Congress members from leveraging insider information to trade stocks and requires them to report their transactions within 45 days.

Interestingly, despite the STOCK Act’s existence, a previous Finbold report highlighted that some lawmakers are in violation. Specifically, Representative John James from Michigan recently disclosed dozens of stock trading transactions almost a year after the transaction.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

The post U.S. politician reports highly suspicious Microsoft (MSFT) stock trade appeared first on Finbold.