As signs keep appearing that the artificial intelligence (AI) hype could be at its final stretch, the sector’s crowned ruler, Nvidia (NASDAQ: NVDA), might lead the declines in the upcoming bear market, at least according to one renowned trading analyst, who has outlined Nvidia stock’s future path.

Indeed, trading expert Alan Santana has pointed out the “great fight that has been going on for decades when it comes to approaching the markets,” which is between fundamental analysis (FA) and technical analysis (TA), in his TradingView post published on September 2.

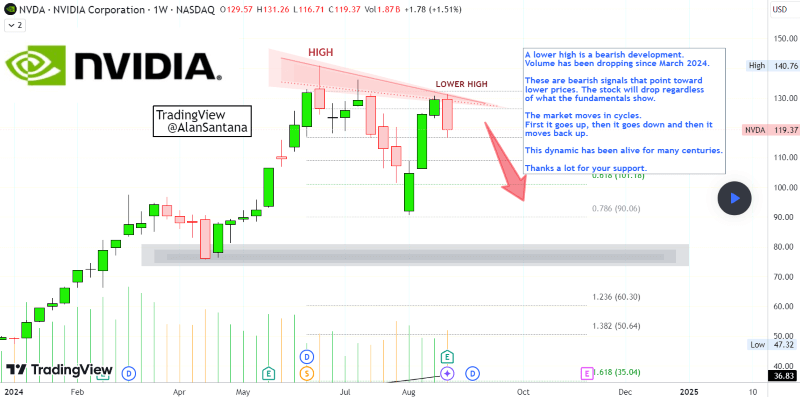

Nvidia stock price performance and NVDA stock forecast. Source: Alan Santana

Specifically, his analysis focuses on the technical side of the spectrum, where he has identified a lower high as a bearish development, alongside trading volume that has been dropping since March 2024, pointing toward lower prices and a drop he believes will happen “regardless of what the fundamentals show.”

“The market moves in cycles. First it goes up, then it goes down and then its moves back up. This dynamic has been alive for many centuries.”

Technical vs. fundamental NVDA stock forecast

Furthermore, Santana highlighted that the chart patterns (TA) are “saying down, while the earnings (FA) are saying up,” referring to Nvidia’s recent earnings report that has beaten analysts’ expectations and arguing that “the stock is not rising because of positive news, company growth or favorable fundamentals; the stock is rising because we are in a bull-market.”

On the other hand:

“There are periods when the sentiment changes and we enter a bear-market. When we are in a bear-market the stock valuations will drop regardless of the news. Short-term there can always be fluctuations and volatility when ‘the earnings’ are released, but long-term the stock will follow the market trend.”

In other words, the analyst stressed that neither CPI, the earnings, nor other developments being bearish or bullish would affect the stock, and it is going to drop in a bear market regardless, hence the poor CPI numbers “yet valuations grow,” the “negative fundamentals and yet, everything grows.”

As he concludes:

“Let’s say we reached the end of the bull-market, therefore we are entering a bear-market. You can have good earnings, good CPI, cut rates and all the rest and yet prices drop. The only way to know if we are in a bull or bear market is by looking at a chart.”

Indeed, according to Santana’s chart analysis, Nvidia shares might fall in the territory below $100 in the next couple of months, which would result in a price at least 16.23% lower than its current situation, provided the technicals remain uncertain.

That said, other finance experts still seem to be generally bullish on Nvidia stock for the next 12 months, placing its average price at $151.79, which would indicate an increase of 27.16% from its price at press time, with the highest target at $200 and the lowest sitting at $90, as per TipRanks data.

Wall Street’s NVDA stock forecast 2025. Source: TipRanks

Nvidia stock price analysis

For the time being, the price of Nvidia shares stands at $119.37, which indicates a 1.51% increase on the day, a decline of 7.90% across the past week, an accumulated gain of 11.28% on its monthly chart, and an advance of 147.81% since the year’s start, as per data retrieved by Finbold on September 2.

Nvidia stock price 1-month chart. Source: Google Finance

Ultimately, Santana’s Nvidia stock prediction based on a technical chart does seem to indicate bearish sentiment, although the technology behemoth might still have some gains up its sleeve, reflecting the importance of doing one’s own research when investing significant amounts of money.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

The post Trading expert outlines Nvidia stock’s path through bear market appeared first on Finbold.