The S&P 500 experienced a remarkable rally, adding $5 trillion in capitalization since its low point on August 5th. This surge represents a 10.5% increase in just 20 trading days, equating to a $250 billion gain per day.

Notably, the index has achieved its average annual return in less than a month, sparking intense interest from investors and analysts alike.

The Kobeissi Letter, a respected financial analysis firm, posted on X this Sunday about the strategies used to capitalize on this market movement. Their approach, which combines technical analysis with fundamental insights, proved particularly effective during this volatile period.

S&P 500 contrarian trade

As explained, The Kobeissi Letter‘s trading strategy relies heavily on exploiting polarized market sentiment, using “contrarian trade” premises. Their analysts emphasize the importance of avoiding herd mentality, especially during periods of extreme market behavior, as currently observed.

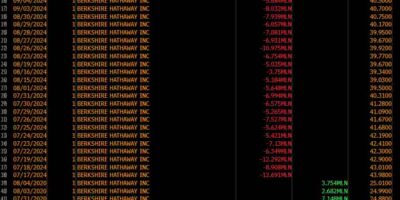

One key indicator they identified was a rapid drop in the daily Relative Strength Index (RSI) from over 70 to below 30 in less than a month, a pattern last observed at the April 2024 market bottom.

S&P 500 index daily chart. Source: TradingView / The Kobeissi Letter

This dramatic shift in sentiment, coupled with what the firm described as a “FULL of panic” selloff, signaled a prime opportunity for contrarian investors. While retail investors feared the demise of the Japanese Yen (JPY) carry trade, institutional players recognized its persistence, creating a disconnect that informed traders could exploit.

Yen carry trade and market recovery

Despite initial concerns about the strengthening Yen and its potential impact on carry trade profitability, The Kobeissi Letter maintained that the fundamental drivers remained intact. Their analysis correctly predicted that the significant interest rate differential between Japan, the United States, and the European Union would continue to support the carry trade.

Japanese Yen (JPY) vs. U.S. Dollar (USD) chart. Source: TradingView / The Kobeissi Letter

This insight proved crucial as the stock market began its rapid ascent. The firm’s clients received timely updates, with initial targets of 5450 for the S&P 500 quickly surpassed. As capital flowed back into the market from the sidelines, the upside accelerated, leading to revised targets that closely matched the index’s closing levels.

The Kobeissi Letter‘s approach, combining technical and fundamental analysis, has reportedly yielded impressive results since the firm’s inception in 2015. In particular, their published annual performance reports claim returns exceeding 340% for their trading setups from 2020 through 2023.

Looking ahead, the firm continues to provide analysis of potential market directions. They stress the importance of viewing market volatility as an opportunity rather than a threat. This perspective, coupled with their dual focus on long-term fundamental theses and short-term technical roadmaps, forms the core of their investment philosophy.

As the market digests this remarkable rally, investors and analysts alike are keenly watching for signs of sustainability or potential pullbacks. The S&P 500’s ability to add its average annual return in just 20 trading days underscores the current market’s dynamism and the potential rewards for those who can accurately interpret and act on market signals.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

The post S&P 500 surges $5 trillion in 20 days; contrarian traders take profits appeared first on Finbold.