Although it recently received a major blow in the form of a catastrophic sell-off, many investors and traders wonder if this might be the perfect opportunity to stock up on some cheap Super Micro Computer Inc. (NASDAQ: SMCI) shares or ‘buy the dip.’

Indeed, SMCI stock has continued to dip as investors reacted to a scathing report by short seller Hindenburg Research and the technology company’s announcement that it would have to delay the filing of its 10-K annual report, raising concerns regarding its long-term viability.

Positive signs for SMCI stock

On the other hand, investment research platform Barchart has reported that SMCI stock was “eyeing a longer-term gross margin rebound, with supply chain hiccups that spiked component prices expected to smooth out over the coming year,” adding that:

“Management is optimistic, pointing to reduced manufacturing costs from new facilities in Malaysia and Taiwan. Plus, they’re setting their sights on expanding in the Americas and Europe.”

Furthermore, it expects the fiscal Q1 to deliver revenue between $6 billion and $7 billion, ranging from 183% to 230% growth, and non-GAAP EPS (non-generally accepted accounting principles earnings per share) between $6.69 and $8.27.

At the same time, for fiscal 2025, SMCI’s management anticipates $26 billion to $30 billion in revenue, which would indicate 74% to 101% annual growth, while analysts predict EPS of $28.50 in fiscal 2025, up 41.9% annually, with the bottom line to surge another 11% to $31.63 in fiscal 2026.

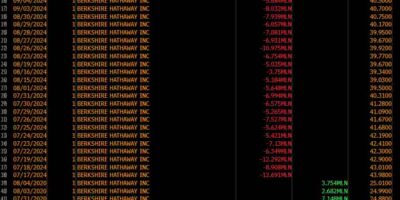

Wall Street’s SMCI stock forecast

It is also worth noting that renowned analysts are cautiously bullish on SMCI stock, rating it as a ‘moderate buy’ and expecting its price to reach an average of $978.50 or an increase of 24.05% from its current situation, according to the latest TipRanks data on September 2.

Wall Street’s SMCI stock forecast 2025. Source: TipRanks

However, immediately after the Hindenburg report, Wells Fargo (NYSE: WFC) slashed its SMCI stock price target 2025 from $650 to $375, albeit maintaining the ‘equal weight’ score, citing “uncertainty/concern over revenue recognition, and SMCI’s history,” as Finbold reported on August 30.

That said, JPMorgan (NYSE: JPM) defended SMCI, arguing that the report offered “limited evidence of accounting mistreatments beyond revisiting the 2020 charges from the SEC, and limited new information relative to the existing and already known business relationship with related companies owned by the siblings of the founder of SMCI.”

Recently, pseudonymous trading expert TradingShot observed that SMCI stock was at a critical juncture, hovering dangerously close to its 100-week moving average (MA), which has also proven a resilient support level for SMCI shares and could send it to a 400% rally to a target price of $2,000.

SMCI stock forecast and price performance analysis. Source: TradingShot

SMCI stock price history

For the moment, the price of SMCI at press time stood at $437.70, which suggests a 2.48% decline on the day, a massive dip of 27.89% across the past week, and an accumulated drop of 29.93% on its monthly chart while still recording a 53.34% gain year-to-date (YTD), as per data on September 2.

SMCI stock price history year-to-date (YTD) chart. Source: Google Finance

So, why is SMCI down today and in the past weeks? Notably, the answer to the question of ‘why is SMCI stock dropping’ could lie in the Hindenburg report, delayed annual filing but also ongoing shipment delays due to supply chain issues and delayed Nvidia (NASDAQ: NVDA) Blackwell chips, essential for SMCI’s high-marking DLC solution.

Ultimately, trends in the stock market can easily change, so doing one’s own research, keeping up with SMCI stock price history, and any relevant SMCI news like when is SMCI earnings date and the like, is critical when investing significant amounts of money in this stock, under a discount or without.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

The post SMCI stock is down; Should you buy the dip? appeared first on Finbold.