Following her recent losses in the stock market, Republican Representative Marjorie Taylor Greene has updated her portfolio to include equities that have dominated the market in gains throughout 2024.

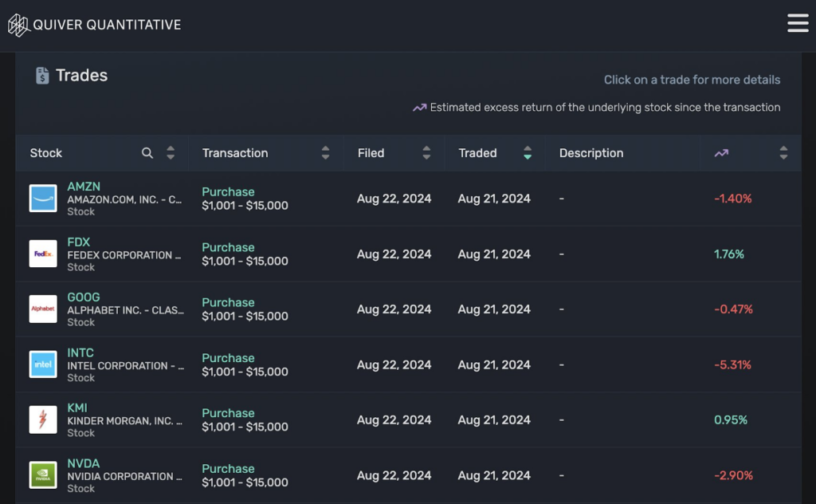

According to data shared by Quiver Quant, the lawmaker purchased up to $90,000 worth of stocks across several major companies. The transactions were filed on August 22, 2024, but were executed a day earlier on August 21, 2024.

Among her purchases was Amazon (NASDAQ: AMZN), where Greene bought between $1,001 to $15,000 shares. Despite the high-profile nature of this acquisition, Amazon’s stock has since declined by 1.40%.

She also invested a similar amount in FedEx (NYSE: FDX), a decision that has so far paid off, as the stock appreciated by 1.76% following her purchase.

Greene acquired shares in Alphabet (NASDAQ: GOOG), although the stock saw a slight dip of 0.47% after the transaction. Another notable addition was Intel (NASDAQ: INTC), whose stock price declined sharply by 5.31% after her acquisition.

Her investments also included Kinder Morgan (NYSE: KMI), which showed a modest gain of 0.95% post-purchase. Lastly, she added Nvidia (NASDAQ: NVDA) to her portfolio, though the stock, which has garnered significant attention for its rapid rise in recent years, dropped by 2.90% after her investment.

Marjorie Taylor Greene updated stock portfolio. Source: Quiver Quant.

Greene’s losing bets

It’s worth noting that Finbold reported that the politician had suffered notable losses in stock selections, including Trump Media (NASDAQ: DJT) and Crowdstrike (NASDAQ: CRWD), before the latest purchases.

This comes when many politicians involved in stock trading have recorded significant profits, raising questions about potential conflicts of interest in their stock choices.

According to Quiver Quant, estimates indicated that Congress members made $11.8 million in unrealized gains in the stock market on August 23, one of the largest daily gains in history.

Interestingly, some of the biggest winners include former House Speaker Nancy Pelosi, whose bet on Nvidia has attracted significant attention.

U.S politicians stock returns for August 23. Source: Quiver Quant.

Overall, these trades come at a time of heightened scrutiny over congressional stock trading, with increasing calls for stricter regulations to prevent potential conflicts of interest.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

The post Rep. Marjorie Taylor Greene just updated her stock portfolio appeared first on Finbold.