Though members of the U.S. Congress are known for making well-timed and lucrative trades, the Republican Representative Marjorie Taylor Greene has been becoming known for losing significant amounts of money on her stock market activities.

After her ill-fated investment in Trump Media (NASDAQ: DJT) gained attention amidst the electoral chaos of June and July 2024, another of her trades started gaining notoriety in late August.

On May 21, Greene invested up to $15,000 in the semiconductor giant Advanced Micro Devices (NASDAQ: AMD) and reported the trade in compliance with the STOCKS Act.

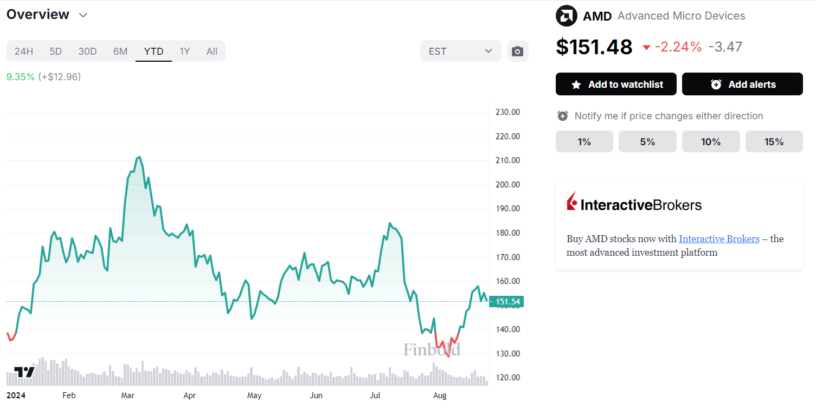

As it turned out, AMD was at the end of its spring rally at the time of the purchase and has – barring a strong yet brief rally in July – declined 7.93% between May 21 and the early market on August 26.

AMD stock YTD price chart. Source: Finbold

While it is impossible to determine exactly the dollar figure the Representative is down on the trade due to lax reporting standards that apply to U.S. politicians, she is down between approximately $80 and about $1,200 on her AMD shares.

Is Marjorie Taylor Greene truly down on her AMD stock bet

Still, it is worth pointing out that Greene has been purchasing AMD shares for years and is in fact, likely in the green on the entire investment, which may be as large as $60,000.

The chipmaker’s stock rose 62.37% between January 21, 2021 – the time of the first reported purchase – and press time. It is also up 96.10% since the one made on May 19 of the same year and has risen 26.89% since the third acquisition, dated February 22, 2022.

Additionally, while Greene’s luck with AMD has been middling for the most part, she has, without a doubt, made the right call when she purchased up to $15,000 worth of Nvidia (NASDAQ: NVDA) shares on July 19, 2021. Since then, they have appreciated some 600% in value.

Furthermore, the Representative is apparently again betting on a strong Nvidia rally – likely the one expected to come after the next earnings report is published on August 28, 2024 – as she again bought up to $15,000 worth of NVDA stock on August 21.

Finally, there is reason to expect the investments in the technology behemoths will prove lucrative given that Greene may possess knowledge that could be seen as insider information, given that she sits on the House Oversight Subcommittee on Cybersecurity, Information Technology, and Government Innovation.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

The post Here’s how much Marjorie Taylor Greene is down on her AMD stock bet appeared first on Finbold.