Former House Speaker Nancy Pelosi’s stock trading prowess has long stood out, particularly for the timing of her purchases and the significant returns that followed.

However, a review of her recent investment activity suggests that Pelosi may be losing her edge, as several missteps have come to light.

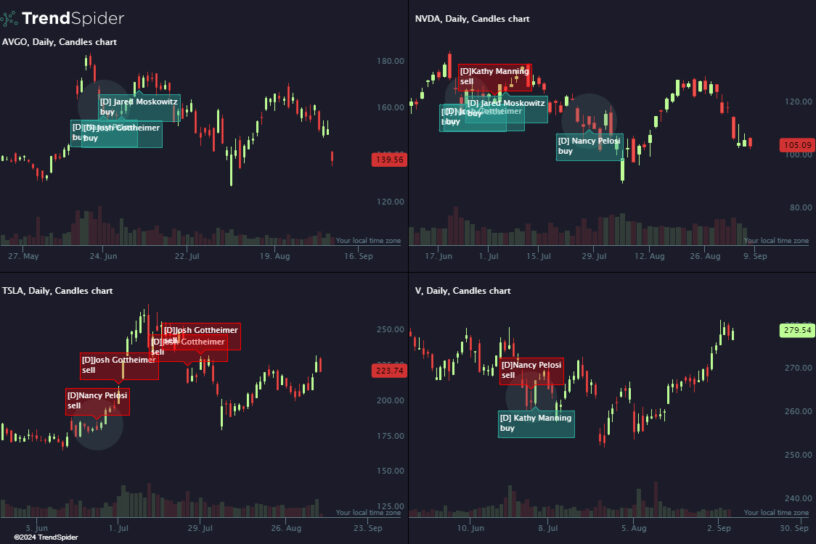

Notably, some of her stock picks have coincided with periods of underperformance, as illustrated by data from the charting platform TrendSpider in an X post on September 6.

Nancy Pelosi stock trading activity. Source: TrendSpider

Nancy Pelosi’s Broadcom purchase

One of Pelosi’s more high-profile investments was in Broadcom (NASDAQ: AVGO), which she bought near its yearly peak in early July when it was trading above $150.

Despite her historical ability to buy stocks at opportune moments, the price has since pulled back, leaving Pelosi at a loss on this purchase. As of the latest trends, AVGO has struggled to recover its earlier levels, weighed down by bearish market sentiment driven by concerns about the economy and disappointing jobs data.

At the time of writing, AVGO was trading at $136, having dropped nearly 14% over the past week.

AVGO one-week stock price. Source: Finbold

Nvidia losses

Pelosi also has favored semiconductor giant Nvidia (NASDAQ: NVDA), a key stock in her portfolio, thanks to its pivotal role in the booming artificial intelligence (AI) sector.

She initiated buys around elevated prices, only for Nvidia’s stock to correct shortly after. Despite a second attempt to average down during another dip, Pelosi remains at a loss on both of these purchases.

It’s worth noting that a previous report indicated that, in early 2024, Pelosi earned more than her entire annual congressional salary from her Nvidia investments.

As of the last market close, NVDA was trading at $102, with daily losses of over 4%. Nevertheless, the company’s bet on AI has propelled the stock more than 110% higher in 2024.

NVDA one-week stock price. Source: Finbold

Tesla sale

In contrast, Pelosi sold Tesla (NASDAQ: TSLA) shares just before the electric vehicle (EV) maker saw a significant rally.

According to a Finbold report, Pelosi’s Tesla sales likely occurred on June 24, 2024, from a batch she purchased in March 2024. With Tesla’s stock underperforming at the time, Pelosi’s sale resulted in losses of approximately $400,000, as the stock price fell from around $340 to $182 at one point.

Pelosi’s premature exit from Tesla left substantial potential gains on the table, a rare misstep for a politician known for holding onto high-growth companies.

Since her exit, Tesla has rallied 15%. As of now, TSLA has reclaimed the $200 resistance level. At press time, the stock was trading at $210, with daily losses of 8%, though is still down 15% year-to-date.

TSLA one-week stock price. Source: Finbold

Visa sale

In another missed opportunity, Pelosi sold Visa (NYSE: V) shares just before the stock experienced a major breakout. Visa has benefited from macroeconomic conditions that have favored its business model.

Pelosi’s sale, which occurred on July 1, 2024, saw her offload between $500,000 and $1 million worth of stock. Since then, Visa has risen over 6% and was trading at $279 as of press time.

V one-week stock price. Source: Finbold

In summary, although the market is unpredictable, Pelosi’s recent trades deviate from her historical pattern, raising questions about whether her golden touch in the stock market has dulled.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

The post End of an era: Is Nancy Pelosi losing her stock market touch? appeared first on Finbold.