After a three-year-long probe into its monopolistic practices, Alibaba (NYSE: BABA) received a green light from the Chinese State Administration for Market Regulation (SAMR) in a statement on August 30, in what some experts see as a ‘new start’ for the e-commerce giant.

After being placed under a probe and fined $2.8 billion in 2021 for its unfriendly practices, including exclusive agreements for sellers and unfriendly market practices towards its rivals, Alibaba is seemingly yet again on good terms with the Chinese regulators, which is crucial for its operations and growth.

The restructuring efforts included addressing the issues highlighted by SAMR and reorganizing sectors such as ride-hailing, online education, and commerce to ensure compliance with regulations.

Jefferies analyst sees it as a “new start” for Alibaba

In a note released on August 30, analyst Thomas Chong from Jefferies reacted to the news by issuing a reiterated price target of $116 while maintaining a “buy” rating. Chong cited the recent approval from SAMR as an essential event, highlighting that Alibaba’s restructuring path in 2021 has proven successful.

“SAMR highlights that BABA has completed rectifications over the past 3 years with good results. For BABA, it highlights this is a new start and that it invests in innovations adding value to society,” said Chong.

Citing a 2021 report, Jefferies’ researcher highlighted that Alibaba has since undertaken operations strengthening measures, with clear growth strategies such as the dual primary listing completed on 28 August.

The Chinese government is providing further support to BABA stock

In a swift follow-up to the recent SAMR approval for Alibaba, the Chinese government intervened through the sovereign fund Huijin in the stock market by buying American Depositary Receipts (ADRs) of Chinese stocks, including BABA.

This move is seen as aiding after the Chinese stock market recorded a four-month losing streak, raising concerns about the state of consumers and the overall economy.

Furthermore, the Chinese government’s intervention can be seen as a good sign among investors, as it signaled the state’s preparedness to help private-held firms and the technology industry recover from the impacts of COVID-19 and several regulatory crackdowns that have instigated fears and deterred investments in the private sector.

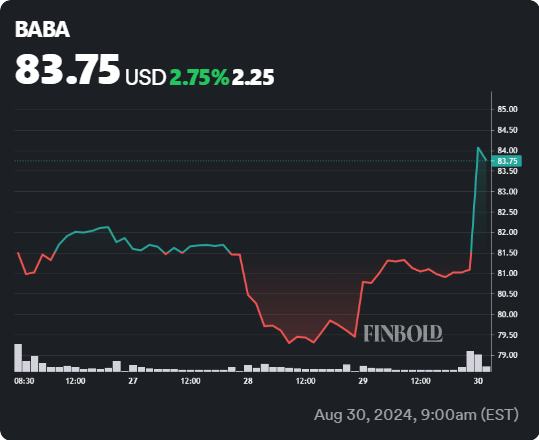

BABA stock immediately reacted positively to the news

The news of the SAMR probe conclusion and renewed backing from the Chinese government inspired August 30 gains of 3.33% that have elevated BABA’s share price to $83.72, erasing the losses of 4.57% from the past five trading sessions.

Furthermore, on a year-to-date basis (YTD), BABA stock has recorded an 8.37% progress.

Yet, the price at the time of writing shows that an almost 40% price increase is needed to reach Jefferies’ $116 price target.

BABA stock 5-day price chart. Source: Finbold

Further examination of the other technical indicators reveals an overall “buy” rating based on 14 examinations, further supported by the moving averages on the BABA’s stock price chart that point towards a “strong buy” rating, countered by a “sell” rating from oscillators.

Technical indicators for BABA stock. Source: TradingView

Additionally, the rising relative strength index (RSI), at 57.72 at the time of writing, shows upward movement and renewed investor interest in BABA stock, further reinforcing the positive momentum surrounding BABA shares.

BABA stock RSI. Source: TradingView

The positive news from SAMR and renewed backing from the Chinese government and retail investors could potentially lead to a further increase in BABA stock price in the upcoming period.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

The post Analyst lays out path for BABA stock to $116, citing a ‘new start’ appeared first on Finbold.