On the cusp of a potentially game-changing earnings report, Nvidia (NASDAQ: NVDA) is likely to witness a significant breakout in its stock, according to analysis.

In particular, a trading analyst known by the pseudonym Market Maestro highlighted the stock’s technical and fundamental setup in an X post on August 24, which points to new highs after the earnings report.

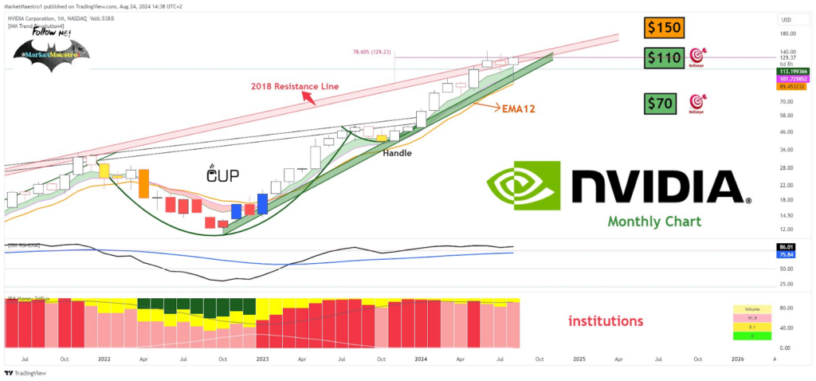

The expert pointed out that NVDA’s recent dip toward the Exponential Moving Average 12 (EMA) at $89 on the monthly chart was a rare buying opportunity reminiscent of the 2022 market bottom. He noted that this kind of correction has been infrequent, making it a pivotal moment for investors.

According to the expert, Nvidia is nearing a crucial resistance level at $129, where the 2018 resistance line intersects with the 78.60% Fibonacci retracement of the June 2024 drop.

NVDA price analysis chart. Source: TradingView

Historically, NVDA has tended to pause at such critical levels, especially before earnings reports. Market Maestro believes that this time, with the suitable earnings catalyst, the stock is primed to break through this resistance and continue its upward trajectory.

Nvidia stock fundamentals

While Nvidia’s fundamentals are strong, the company faces logistical challenges that could impact short-term sentiment. The analyst pointed out that Nvidia has postponed the shipment of its Blackwell GPUs to Q1 2025, primarily due to complexities in Taiwan Semiconductor Manufacturing Company’s (NYSE: TSM) chip-on-wafer-on-substrate (CoWoS) packaging technology.

Specifically, design issues with CoWoS-L technology have forced Nvidia to delay the production of some models. Despite this, the expert remained bullish, seeing this as a potential “excuse” for Wall Street pragmatists but not a fundamental issue derailing Nvidia’s long-term growth.

Notably, on the weekly chart, Market Maestro identified a positive Relative Strength Index (RSI) divergence between the April 2024 and August 2024 lows, which adds to the bullish case. However, he also cautioned that a slight miss in the upcoming earnings report could lead to selling pressure, turning the RSI into a peak pattern—a risk that investors should be aware of.

He emphasized that the report, scheduled for release on August 28, will be the decisive factor for NVDA’s next move. Despite some risks, such as market reactions to perceived weaknesses and the delays in GPU shipments, the technical setup suggests that a strong earnings report could propel NVDA past the $129 resistance and set it toward $150.

“Based on the current technical and fundamental indicators, the earnings report to be released on August 28th will be decisive for the stock’s direction.<…> I believe it will sharply break above $129 with a good ER and quickly advance towards the $150 target,” the expert noted.

In the meantime, anticipation is building ahead of the earnings report for the artificial intelligence (AI) stock. Consensus estimates for Nvidia’s second-quarter revenue have surged to $28.84 billion, while net income projections have risen to $14.95 billion.

NVDA price analysis

This anticipation is reflected in the stock’s recent performance, which has seen bullish momentum. As of the close of markets on August 23, NVDA was trading at $129, rallying almost 5% in 24 hours.

NVDA seven-day price chart. Source: Finbold

Overall, ahead of the earnings report, the semiconductor giant must avoid falling below $125 in the short term to maintain the momentum needed for a move toward $150.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

The post Analyst explains how Nvidia’s decisive earnings will push NVDA to $150 appeared first on Finbold.