Although Nvidia (NASDAQ: NVDA) is expected to surpass analysts’ Q2 2024 earnings, some investors are exhibiting bearishness ahead of the call.

In particular, data shared by Trend Spider in an X post on August 27 highlighted unusual options activity. It revealed a notable amount of bearish call selling, suggesting that traders are preparing for a potential downside move in Nvidia’s stock.

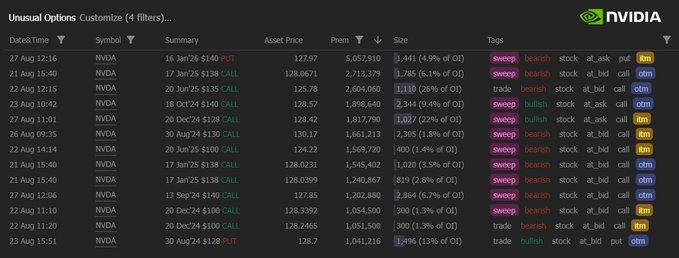

A snapshot of unusual options activity from August 21 to August 27 highlights options contracts with $1 million or more premiums. The data indicates a significant skew toward bearish trades, particularly in call selling.

NVDA options call. Source:Trend Spider

Among the most prominent trades is a $140 PUT for January 16, 2025, with a premium exceeding $5 million and an open interest size accounting for 4.9% of the total open interest (OI). This trade suggests a strong bearish outlook for Nvidia in the long term.

Several other call trades are executed at out-of-the-money (OTM) strike prices, such as $138 for January 17, 2025, $138 for June 20, 2025, and $140 for October 18, 2024. These trades carry significant premiums but relatively small sizes compared to the total OI, with tags like “sweep” and “trade.”

This indicates that investors may be looking to capitalize on potential downward moves in Nvidia’s stock price. The sweeping nature of these trades implies urgency among traders, reflecting expectations of significant volatility ahead.

Triggers on NVDA’s bearish calls

Overall, the bearish sentiment in the options market could be driven by several factors. Nvidia has been a standout performer in the tech sector due to its leadership in artificial intelligence (AI) and graphics processing units (GPUs). However, the stock’s elevated valuations and the possibility of an earnings miss might lead to profit-taking or a correction.

With Nvidia’s earnings report around the corner, investors are expected to pay close attention to key metrics such as revenue growth in data centers, gaming, and AI-related segments and guidance for the coming quarters. A miss or slight decline in these growth areas could intensify the bearish trend evident in the options market.

As things stand, analysts project that the semiconductor giant will likely report $28.7 billion in revenue for the quarter, representing an increase of more than 100% from the year before.

With the high revenue projection, investors will hope NVDA builds on the current momentum and targets the $130 resistance, with a long-term target of $150.

NVDA price prediction and analysis

To gather insights into how the stock is likely to trade in the coming months, Wall Street analysts at TipRanks forecast that NVDA will trade at an average price of $149.74 in the next 12 months. The 36 analysts forecast a high price of $200 and a low of $100.

Wall Street analysts NVDA 12-month price prediction. Source: TipRanks

In the meantime, at the last market close, Nvidia had made a notable recovery to trade at $128, reflecting daily gains of about 1.4%.

NVDA one-week price chart. Source: Finbold

Overall, the stakes are high for Nvidia heading into the earnings slated for later today, August 28, as the financials will also play a key role in determining the next trajectory of the AI wave.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

The post Nvidia large investors turn bearish ahead of earnings; What’s next for NVDA? appeared first on Finbold.