The United States economy continues to be gripped by fears of a possible recession, which at one point triggered panic in the stock and cryptocurrency markets.

Amid these concerns, economist Henrik Zeberg has asserted that a recession is inevitable, possibly hitting in the fourth quarter of 2024. In an X post on August 23, Zeberg revised his targets for key financial assets, signaling the approach of what he predicts will be a historic recession.

He outlined significant upward revisions for the S&P 500, Nasdaq, Dow Jones, and Bitcoin (BTC) while warning of a looming economic downturn.

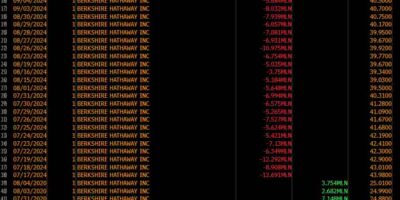

Stock and Bitcoin price new targets

He now forecasts the S&P 500 to reach a range between 6,100 and 6,300 points, a significant increase from his previous target of approximately 3,900 in December 2022. This revision comes as the index continues to record substantial highs above the 5,500 mark.

Similarly, he has adjusted his Nasdaq target between 24,000 to 25,000 points, up from around 11,500. The Dow Jones is expected to surge to 45,000, compared to the previous target of 33,000.

In the cryptocurrency space, Zeberg sees Bitcoin soaring to $115,000 and $120,000, a dramatic rise from his December 2022 target of $16,500.

Reflecting on his past predictions, Zeberg noted that while many were bearish in December 2022, anticipating an imminent market crash, he remained optimistic. His bullish predictions were based on his proprietary Business Cycle Model, which suggested that fears of an immediate recession were premature.

“I have stuck to the #BlowOffTop call I made back then. I still do! Euphoria will develop in US markets. I said, that before Final Top, “Bears would become Bulls” – and that I would be ridiculed at the top of the BlowOffTop for my call for a major top and Crash,” he said.

Worst recession ahead

Despite his optimistic market targets, Zeberg’s latest analysis carries a stark warning. He predicted a severe recession, which he believed would be the worst since the Great Depression of 1929. According to the economist, the coming bear market will unfold in two phases: a deflationary phase followed by a stagflationary period, with a mid-way bounce as the Federal Reserve intervenes in 2025.

He reiterated his previous call for a “Blow-Off Top” in the markets, a situation where prices surge to unsustainable levels before collapsing. Zeberg emphasized that the markets have not yet reached this peak, but once they do, he expects to face ridicule for his predictions of a major top and subsequent crash.

Overall, Zeberg’s revised targets suggest that investors may still see significant gains in the short term, especially in equities and cryptocurrencies. However, his warning of an impending recession is a cautionary note for those looking to capitalize on the bullish momentum.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

The post Economist revises Bitcoin and S&P 500 targets that will usher in recession appeared first on Finbold.