In one of the biggest daily gains in 2024, Peloton (NASDAQ: PTON) stock added 35% to its value in a single trading session after the company announced surprise quarterly revenue growth for Q4.

This company specializes in providing home fitness equipment and has recorded quarterly revenue losses for the previous two years. The latest earnings report on August 22 revealed quarterly revenue of $643.6 million, which beat analyst expectations of $630.1 million.

Peloton also reported narrowing expected losses of $30.5 million, a notable improvement from just a year ago, when $241.8 million were expected.

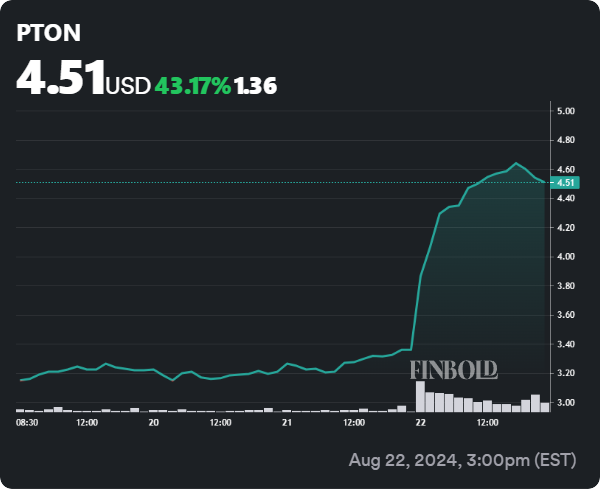

Peloton stock price chart

Despite a significant one-day surge, PTON stock is down 21.82% from its January 1 price of $5.82.

In addition to a 35% surge in the trading session on August 22, when PTON shares closed trading at $4.55, gains from the latest trading day, showing a 40.65% gain, bolstered the previous five trading sessions.

PTON stock 5-day price chart. Source: Finbold

Fundamental changes at Peloton proved effective

On May 2, Peloton announced restructuring efforts aimed at cost-cutting, which meant layoffs for 15% of the total workforce, or 400 workers.

In addition, Peloton’s CEO Barry McCarthy, who had been with the company for two years, announced his departure after taking over from the founder, John Foley.

The measures proved seemingly effective, as only one quarter later, Peloton reported in-line revenue and growing subscription revenue up 2.3%, or $431.4 million.

Wall Street will need more convincing on PTON stock

Despite a surprise in revenue, Peloton will need to provide more convincing to Wall Street analysts as they view it as a one-off event.

On August 22, JPMorgan downgraded Peloton from ”overweight” to “neutral,” lowering its price target from $7 to $5. Despite Peloton’s recent positive performance, including consecutive quarters of positive Adjusted EBITDA and expectations of over $200 million in annual cost savings by FY25, challenges remain.

The connected fitness industry is still experiencing year-over-year declines, and macroeconomic pressures are affecting demand, leading to a softer-than-expected revenue outlook for FY25.

JPMorgan is encouraged by Peloton’s debt refinancing and cost-cutting efforts. Still, with limited visibility on the company’s growth prospects, especially after a 35% surge in its stock, the firm opted for a more cautious outlook.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

The post Here’s why Peloton (PTON) stock is surging appeared first on Finbold.