The most recent 13F filings revealed some notable moves among hedge funds. They show interesting purchases and sales by financial firms such as Soros Fund Management, which recorded some notable divestments.

According to the most recent Q2 holdings report released on August 14, George Soros’s family office held positions in 177 different stocks and exchange-traded funds (ETFs), worth a total of $5,565,795 as of June 30.

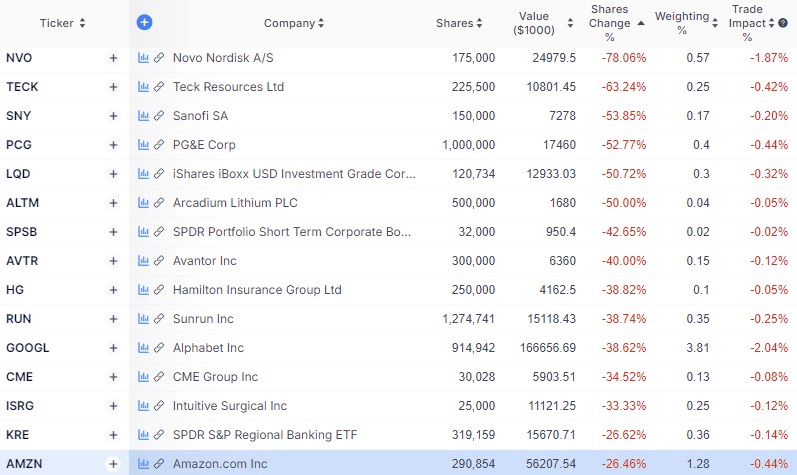

Soros’s most recent stock sales

In a trend that seems to be popular among larger Wall Street institutions right now, Soros Fund Management divested from big tech names.

Soros’s most sizable sale in the previous quarter was a 38.62% reduction in his Alphabet (NASDAQ: GOOGL) position, leaving only 915,000 shares worth just over $166 million.

The second tech divestment was in e-commerce giant Amazon (NASDAQ: AMZN); by trimming its position by 26.46%, Soros is left with 290,850 AMZN shares worth $56.2 million.

Other notable divestments were in Novo Nordisk (NYSE: NVO) by 78.06% and PG&E Corp (NYSE: PCG) by 52.77%.

Largest stock sales in Soros Fund Management portfolio. Source: gurufocus

The sales in these firms might have been motivated by profit-taking and subsequent reinvestment of some of the profits into new holdings from the same sector.

Q2 stock buys by George Soros

Stocks like Alibaba (NYSE: BABA), Apple (NASDAQ: AAPL), Super Micro Computer (NASDAQ: SMCI), and Broadcom (NASDAQ: AVGO) were all new additions to Soros’ portfolio in the latest quarter, with positions that do not exceed 2% of the overall portfolio.

NextEra Energy (NYSE: NEE) experienced the largest position increase from the previous holdings, with over 5,200% position increase, for a total of 900,000 NEE shares.

Ascendis Pharma A/S (NASDAQ: ASND) is the second largest position increase, with a total of 100,000 shares after a 2,813% expansion.

Stocks that experienced the largest position increase in the Soros Fund Management portfolio. Source: gurufocus

Soros seemingly decided to expand and diversify his presence in pharmaceutical and healthcare stocks by trimming his existing positions and using the funds to invest in companies with smaller market caps but higher growth prospects.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

The post George Soros updates his stock portfolio appeared first on Finbold.