For much of 2024, the stock market has been driven by two seemingly opposite forces: the exceptionally strong performance of the S&P 500 and the biggest, mostly tech companies, and by persistent recessionary fears driven by concerns over a possible artificial intelligence (AI) bubble, consistently high interest rates, and the ever-increasing indebtedness of the Federal Government.

In early August, the needle turned more decisively to fear as the Federal Reserve, following its latest Federal Open Market Committee (FOMC) meeting, unveiled an employment report significantly weaker than anticipated.

The report – which revealed that the U.S. has created approximately 70,000 fewer jobs in July than expected – is one of the key factors cited by Northwestern Mutual Wealth Management as confirmation that their bet that a recession is coming has been correct.

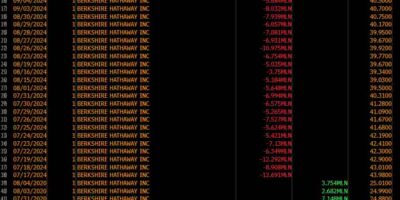

In June, the fund poured as much as $2.7 billion into BlackRock’s 20+ Year Treasury Bond exchange-traded fund (TLT) – a wager that would pay off the most if U.S. stocks experience a devastating crash.

Investing in bonds directly or through vehicles such as TLT is generally seen as a recessionary bet since treasuries generally perform well during a crash as they represent a safe harbor for wealth in times of crisis. Long-term bonds also tend to perform well as they usually offer fixed interest – a lucrative deal at times of low inflation, which usually coincide with recessions.

$300 billion money manager explains the bond bet

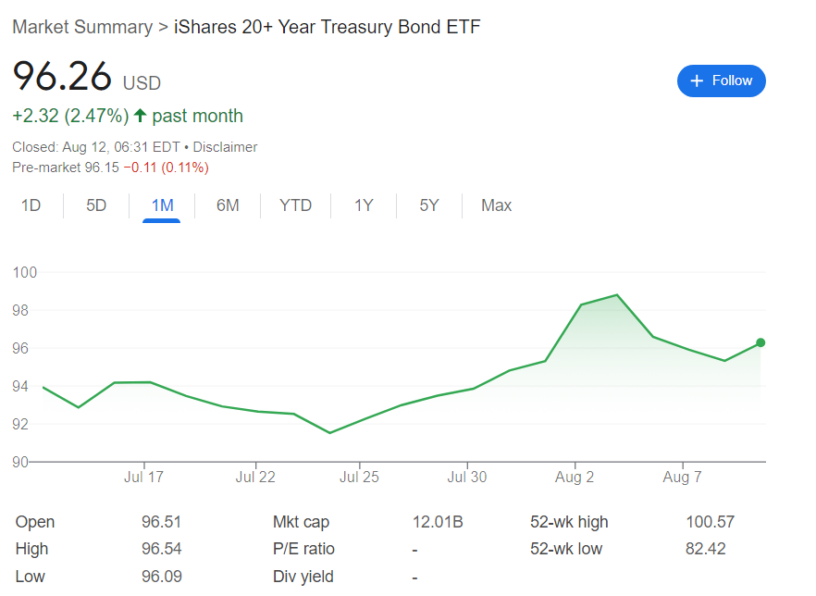

By August 12, the bet had already started slowly paying off. The ETF has been trading upward—though with significant volatility—since June and saw its biggest spike on August 5, the day the stock market experienced its worst single-session crash since 2022.

TLT 30-day price chart. Source: Google

Indeed, just a few days after the most recent ‘Black Monday,’ Northwestern Mutual Wealth Management’s Brent Schutte explained that the investment in TLT has been driven by the expectation that a recession is approaching, though it has been slowed down by the high influx of money into the system and by the many years of exceptionally low interest rates.

Schutte also opined that the weak jobs report vindicates both the recessionary forecasts and his company’s June bonds bet, as employment is usually the last facet of the economy to break.

Looking forward, he also explained that the ETF investment is to be held for another year at least and added that the confirmation of whether there truly is a recession will come within 6 to 8 months, though Schutte also opined that it may have already started.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

The post Fund manager bets $2.7 billion on imminent recession appeared first on Finbold.