Shortly before Amazon (NASDAQ: AMZN) stock took a massive dive in late July and early August, which has seen its price decline by over 16% in a couple of weeks, the e-commerce and technology behemoth’s founder and executive chair Jeff Bezos cashed in on over $1.7 billion in Amazon shares.

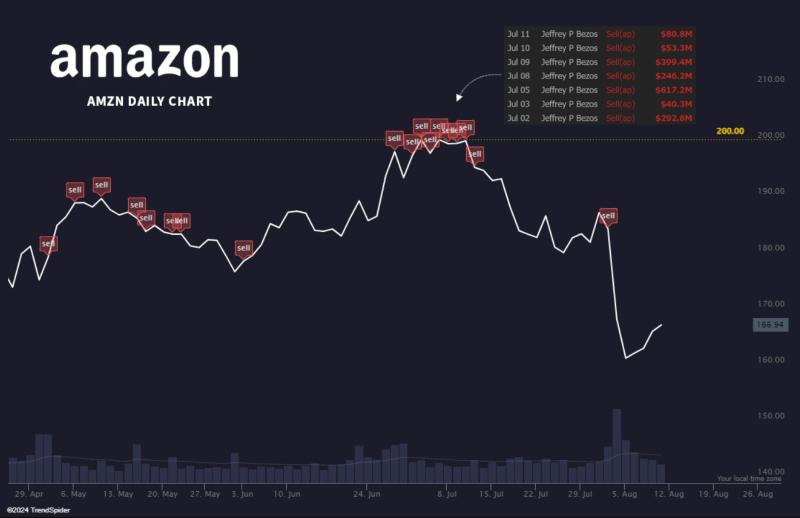

Specifically, Bezos sold $1.73 billion worth of Amazon stocks in multiple transactions in early July this year, right before AMZN shares started to decline, according to the information gathered and shared by market analytics and trading platform TrendSpider in an X post on August 11.

Jeff Bezos’ AMZN stock sales vs. AMZN stock price. Source: TrendSpider

Indeed, the platform’s data shows that Bezos divided his Amazon stock sales into seven transactions, ranging from the lowest at $40.3 million on July 3 to the highest at $617.2 million on July 5, with all seven trades bringing up to the total of $1.73 billion across mere nine days.

Amazon stock price analysis

Not long after his final July sale of AMZN shares, Amazon stock started to decline, and is currently down 14.17% on it monthly chart, albeit recovering 8.31% across the past week and advancing 0.69% on the day, alonsige a 0.65% gain in pre-market, with a closing price of $166.94, as per data on August 12.

Amazon price 1-month chart. Source: Google Finance

As it happens, the most recent Amazon stock dump by the company’s founder arrived after he had already divested from around $8.5 billion worth of AMZN shares in February, but it does not mean that he has completely given up on Amazon as he still owns over 920 million AMZN stock shares.

Why is Bezos selling Amazon stock?

In fact, Bezos might have simply taken the opportunity to profit following the explosive Amazon stock price rally in 2023 and 2024 after his resignation from the role of Amazon’s CEO in 2021, with the reasoning that stocks cannot continue to increase their price without any corrections.

On top of that, some have suggested that he might be raising money to buy the Seattle Seahawks, a professional American football team that competes in the National Football League (NFL), as well as devoting more time to work on his space company Blue Origin.

That is not to say that Amazon cannot fail, as evident in the discontinued production of its security robot, Astro for Business, as well as ending support for it as it moves its focus to household robots, with its generative artificial intelligence (AI) shopping assistant chatbot, Rufus, receiving mixed reviews.

Elsewhere, Amazon’s recent earnings and revenue projections fell short of expectations, leading a number of Wall Street analysts to lower their price targets for AMZN stock in the next 12 months, retaining a ‘strong buy’ rating, as Finbold reported on August 8.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

The post Monster $1.7 billion insider trading alert for Amazon stock appeared first on Finbold.