The share price of American software company Palantir Technologies (NYSE: PLTR) has recorded a remarkable week following the company’s stronger-than-expected earnings report.

Notably, in the second-quarter earnings report, Palantir’s performance soared, showing significant revenue growth and new client acquisitions. At the same time, the firm continues to see robust customer base growth, with a focus on commercial clients, leading to increased revenue and profitability.

Specifically, Palantir’s revenue for the quarter reached $678 million, while adjusted income from operations rose to $254 million. Additionally, the firm raised its full-year guidance, reflecting strong confidence in future growth.

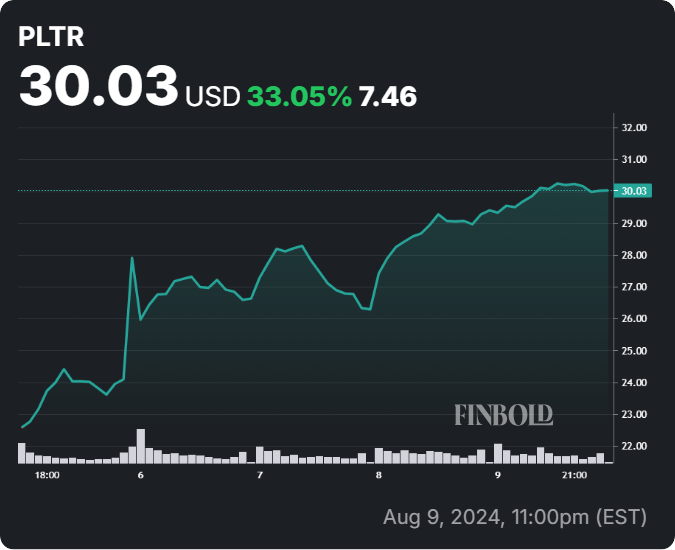

Indeed, PLTR has emerged as a key beneficiary of this momentum, surging by over 38% in the last seven days. At the close of markets on August 9, the equity was valued at $30, with a 24-hour gain of over 3%. Moreover, Palantir’s venture into the artificial intelligence (AI) scene has been a major catalyst in 2024, with PLTR rising over 80% on a year-to-date basis.

PLTR one-week stock price chart. Source: Finbold

Analysts set PLTR’s share price

Amid this bullish momentum, analysts have offered their Palantir stock performance projections over the next 12 months. Sixteen Wall Street analysts on TradingView forecast that PLTR will likely correct in the next 12 months and trade at an average price of about $24.63.

This forecast represents a significant potential decrease of 17.93% from the current trading price of $30.01. The estimate spans a wide range of outcomes, reflecting the company’s uncertain market outlook.

The highest target within the next year stands at $38, suggesting an optimistic 26.62% increase, while the lowest projection is a dramatic downturn to $9, marking a potential 70.01% decrease.

Despite these contrasting viewpoints, the overall analyst sentiment leans towards a neutral stance. Out of 23 analysts who have rated the stock over the past three months, the majority have recommended holding it, while six analysts advocate for a strong buy and three recommend buying.

On the other hand, the bearish perspective includes seven analysts advising a solid sell and one recommending a sell.

Palantir’s fundamentals

Although analysts are projecting a bearish outlook for the equity, the stock has the potential to sustain its current momentum if Palantir demonstrates the ability to maintain these elevated performance levels, particularly in its high-growth U.S. commercial segment. Indeed, the bullish momentum is likely to be sustained if Palantir’s partnerships, such as the one with Microsoft (NASDAQ: MSFT), work out.

Additionally, investors should be on the lookout for the company’s focus on innovation and monitor any indications of pressure on valuation.

In summary, not only will these fundamentals play a key role, but the stock is also susceptible to prevailing economic factors, such as concerns about a possible recession in the United States.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

The post Analysts set Palantir (PLTR) stock price for next 12 months appeared first on Finbold.