Although its recent price performance was lackluster, Render (RENDER), a decentralized graphics processing unit (GPU) platform and cryptocurrency dubbed the ‘Nvidia of crypto’ due to the similarities with blue-chip behemoth Nvidia (NASDAQ: NVDA), seems to have sparked whale confidence.

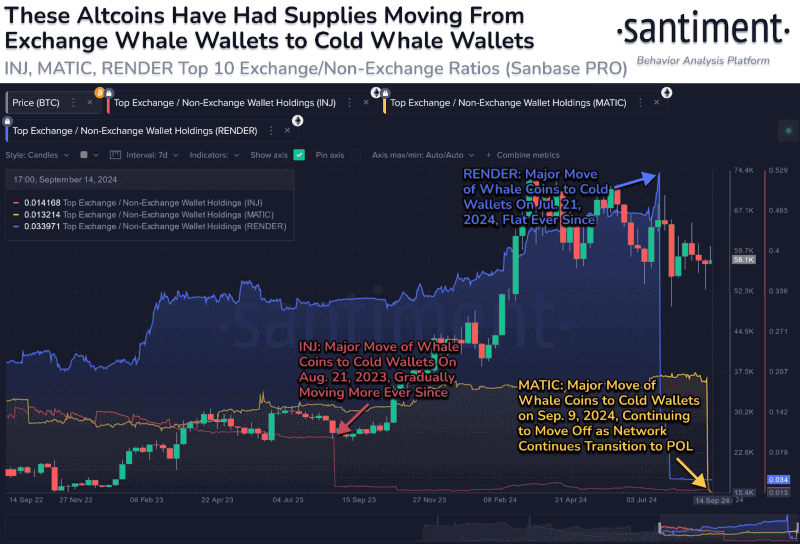

As it happens, Render is among several altcoins that recently saw plenty of price anomalies after specific transfers by the market’s largest traders, according to the data shared by Santiment, a crypto market intelligence platform tracking blockchain and social metrics, in an X post on September 17.

Specifically, Render, alongside several other altcoins, including Injective (INJ) and Polygon (MATIC), witnessed these anomalies after whale exchange wallet supply suddenly shifted to whale cold wallet supply, and Santiment analysts said these “anomalies are fantastic as both short & long term signals.”

RENDER, INJ, and MATIC exchange/non-exchange ratios. Source: Santiment

Bullish signal for RENDER?

Indeed, moving a certain crypto asset from an exchange to offline or so-called ‘cold’ storage, indicates strong confidence in the asset being transferred, and for RENDER, a major move of whale coins to cold wallets happened on July 21 and its top exchange/non-exchange ratio has been largely flat ever since.

In fact, this signals that large holders may be planning to hold onto their tokens in the long term, with little additional accumulation or sell-off activity, as well as confidence in the long-term prospects of the asset, potentially contributing to price growth as they reduce the immediate selling pressure on exchanges.

On the other hand, pseudonymous crypto trading expert D0c Crypto has observed that “after being denied FIB 0.382 at $5.375, RENDER is heading towards the Golden Pocket between $4.49 and $4.626 (…) or the daily demand zone between $4.26 and $4.37.”

RENDER(USDT perpetual futures Fibonacci retracement analysis. Source: D0c Crypto

As the chart demonstrates, RENDER will likely face significant resistance at the $5.375 level and highest at $5.839 if it tries to rally while its support rests at $4.626 and $4.092, and breaking these levels could indicate further downside potential for the ‘Nvidia of crypto.’

However, the analyst also said that there was “no need to worry, September is tough, all you need to do this month is [dollar-cost average (DCA)] daily,” and advised his followers to “ignore price movements, the big RENDER run is coming in the fourth quarter.”

Render price analysis

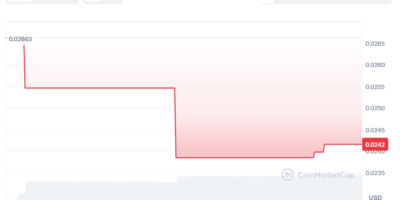

For now, RENDER is changing hands at the price of $4.83, which indicates a 1.79% decline in the last 24 hours, adding up to the drop of 8.06% across the previous seven days, while recording an increase of 5.97% in the past month, according to the most recent chart information retrieved by Finbold.

Render price 30-day chart. Source: CoinMarketCap

All things considered, while Render’s price action might not seem like much in the short term, whales are bullish on its longer-term future. However, trends in the crypto market can easily shift, so doing one’s own research is critical when investing.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

The post ‘Nvidia of crypto’ shows ‘fantastic’ signal as whales make bullish move appeared first on Finbold.