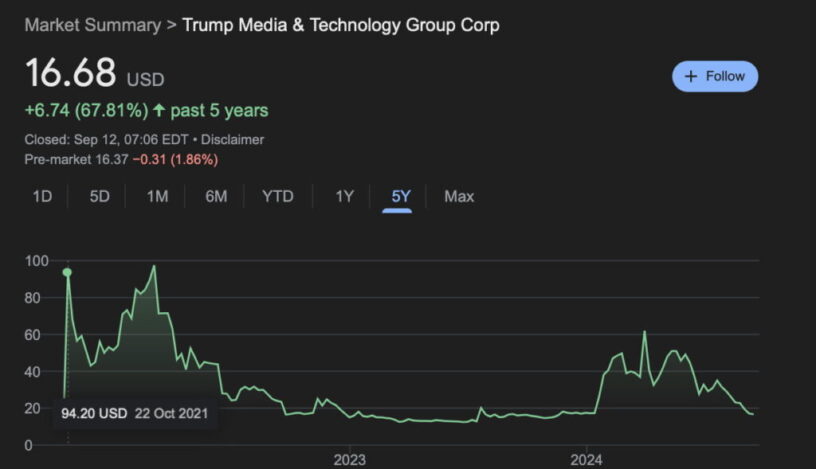

Trump Media (NASDAQ: DJT) took a hit on September 11, plunging as much as 15% before closing 10% down at $16.68, shedding $1.95 (-10.47%).

In pre-market trading on Thursday, September 12, the slide continued, with shares slipping to $16.36, down another $0.32 (-1.92%).

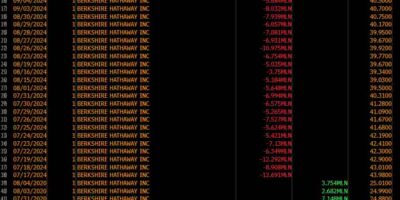

MTG stock purchase on 22 October, 2021. Source: Google Finance

The catalyst? The aftermath of the presidential debate between former President Donald Trump and current U.S. Vice President Kamala Harris, where it seems the market leaned in favor of the Vice President, as reflected by the continued sell-off in Trump Media stock.

Trump Media stock’s latest drop adds to the stock’s long-running decline, particularly since Representative Marjorie Taylor Greene entered the fray.

On October 22, 2021, she invested up to $50,000 in DJT when shares were soaring at $92-$94. Since then, the stock has nosedived by around 83%, marking Greene’s entry as a clear peak.

US Congress Buy/Sell Signal

Stay up-to-date on the trading activity of US Congress members. This signal triggers based on SEC updates on all the trades that are made by US Congress members.

MTG stock market performance

Elsewhere, cybersecurity company CrowdStrike (NASDAQ: CRWD) became one of Marjorie Taylor Greene’s more eyebrow-raising moves. On June 24, she opened a new position at $377.93. Fast forward to September 12, and it’s now trading at $253.53—a cool 33% dip. Keep in mind, Greene sits on the House Cybersecurity Subcommittee, adding a certain irony to the situation.

Greene has now evolved into a kind of Jim Cramer-esque figure in the investment world, with her trades inspiring chatter about creating an “Inverse Greene ETF”—an amusing jab given her less-than-stellar performance. As one analyst noted, “Politician trust ratings are at an all-time low,” and Greene’s portfolio isn’t exactly doing much to counter that sentiment.

To add another layer of intrigue, on January 2, 2024, Greene claimed she didn’t own any stocks—only to pull the classic “I’m holding it for a friend” defense when asked why her name still appeared on Congressional stock reports. By May 21, she reported a fresh $840K worth of trades, including 14 new moves totaling around $210K.

Though Greene’s not exactly known for timing the market, she’s certainly taken a page from Nancy Pelosi’s playbook, making big plays on well-known tech giants like Nvidia (NASDAQ: NVDA), among others. And, of course, she’s still holding onto CrowdStrike.

US Senator Buy/Sell Signal

Stay up-to-date on the trading activity of US Senators. This signal triggers based on SEC updates on all the trades that are made by US Senators. Learn more.

Whether these moves pan out or continue to mirror her CrowdStrike experience, only time will tell—but the “Inverse Greene ETF” idea just might have legs.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

The post Marjorie Taylor Greene is down this much on her Trump Media stock bet appeared first on Finbold.