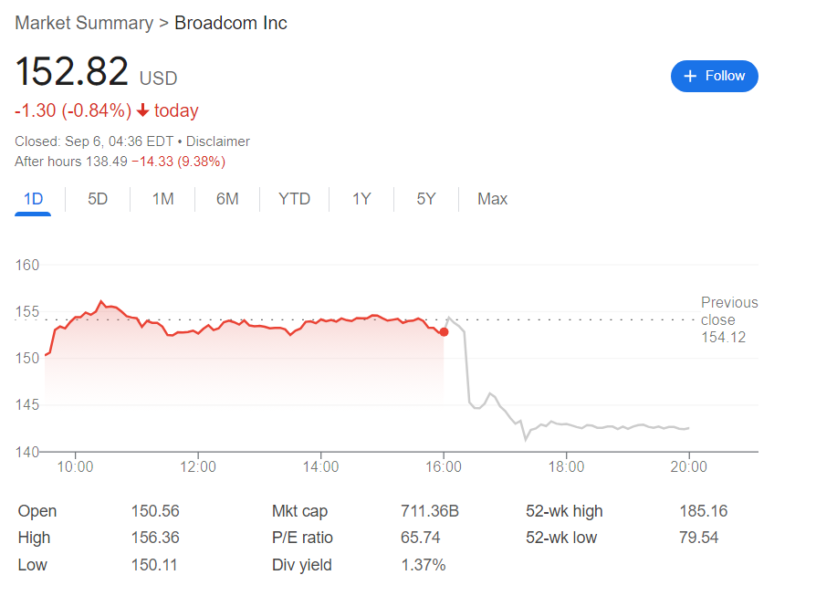

After holding fairly steady with only a modest 0.84% decline during September 5 trading, Broadcom (NASDAQ: AVGO) stock tumbled 9.38% from its close at $152.82 to its latest recorded price of $138.49.

AVGO stock 1-day and after-hours price chart. Source: Google

The fall was triggered by the publishing of the semiconductor and infrastructure provider’s latest earnings report – published after the closing bell on September 5 – which, despite beating revenue and earnings-per-share (EPS) forecasts, disappointed investors.

Why Broadcom’s latest report triggered an after-hours AVGO stock sell-off

Indeed, though revenue came in at $13.07 billion – 0.84% above the expected $12.96 billion – and EPS at $1.24, 2.79% higher than the predicted $1.21, Broadcom posted a net loss of $1.875 billion.

The figure was significantly below the $3.3 billion profit reported in the same quarter of the previous year. Additionally, the chipmaker provided disappointing guidance, estimating its fourth-quarter revenue at $14 billion – a 51% year-over-year increase, despite being slightly below the $14.11 forecasted by analysts.

The company also anticipates its adjusted EBITDA to be around 64% of this projected revenue.

Still, it is worth remembering that the bulk of the disappointing figures in the report come from the continued – but temporary – need to cushion the late 2023 acquisition of VMware, a software company.

Furthermore, Broadcom actually upgraded its expectations for the full-year artificial intelligence (AI) revenue from the $11 billion estimated in the previous quarter to the current $12 billion estimate.

Was the reaction to Broadcom earnings disproportionate?

The sell-off of AVGO shares that followed the report may have been an overreaction once the general outlook for Broadcom is taken into account. Indeed, the chipmaker boasts an overall ‘buy’ rating on the stock analysis platform TradingView at press time on September 6.

Additionally, out of the 46 experts represented, 30 consider Broadcom stock a ‘strong buy,’ 8 rate it as a ‘buy,’ and 8 remain neutral. At the time of publication, there are no ‘sell’ or ‘strong sell’ ratings for AVGO shares.

In terms of the 12-month price target, the chipmaker is expected to only go up in the stock market. On average, AVGO shares are forecasted to rise 26.54% from their latest closing price to $193.38. The lowest predictions would still mean Broadcom stock rises 2.08% to $156 and the highest would see it rocket 57.05% to $240.

The upsides become even greater once the 9.38% extended session drop is considered.

AVGO analyst consensus rating. Source: TradingView

Recent price target revisions demonstrate that little has changed in the analyst outlook for AVGO. For example, on August 29, Citi (NYSE: C) reiterated its ‘buy’ rating of Broadcom but increased the forecast from $156 to $175.

Similarly, on September 3, Susquehanna decided to stick to a ‘buy’ rating and the associated $200 target, while on September 5 – just hours before the earnings were published – Evercore ISI also maintained its positive outlook and $201 price target.

Evercore ISI, in particular, emphasized Broadcom’s potential, assessing that AVGO shares are trading at a discount compared with their peers, especially given the chipmaker’s increasing visibility in the AI space.

Why the Broadcom earnings reaction may have been exaggerated

Nonetheless, it is worth remembering that AVGO stock is universally expected to rise only thanks to the early September market sell-off – a sell-off that wiped out some $1 trillion within a single session and collapsed Broadcom shares from their August 30 prices above $160 to their latest closing price of $152.82.

Still, it may precisely be the recent, broad stock market slump and the general concerns over ‘The September Effect’ that have caused the reaction to Broadcom’s generally decent report to be as strong.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

The post This is why Broadcom (AVGO) stock is crashing appeared first on Finbold.