Recent insider trading allegations involving United States politicians have focused on major stocks such as technology giants Nvidia (NASDAQ: NVDA) and Apple (NASDAQ: AAPL). However, smaller stocks are now drawing attention.

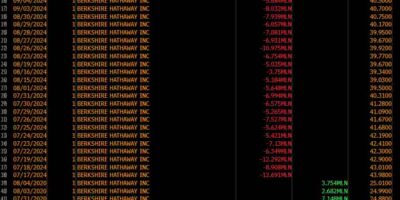

The latest spotlight is on Representative Josh Gottheimer’s May stock purchase of Fair Isaac Corporation (NYSE: FICO), a credit-scoring service firm. According to data from Congress trading tracking platform Quiver Quantitative, shared in an X post on September 4, the stock has surged 53% since the lawmaker’s purchase.

FICO stock performance since purchase by Rep. Josh Gottheimer. Source: Quiver Quantitative

The potential ethical concern arises from Gottheimer’s membership in the House Financial Services Committee, and the platform labels the transaction as “suspicious.”

FICO’s bullish momentum

Interestingly, at the time of the purchase, Fair Isaac was trading near its yearly low of around $1,100, and it has since recorded year-to-date gains of 54%. As of press time, FICO was valued at $1,751.

FICO YTD stock price chart. Source: Finbold

Analysts have also expressed optimism about the stock, pointing to sustained bullish momentum in the coming months. For instance, Oppenheimer rated FICO as “Outperform,” highlighting the company’s long-term potential in the credit scoring industry.

Interestingly, recent gains have also potentially prompted insider selling activity within the company. According to filings before the Securities Exchange Commission (SEC), Fair Isaac’s Chief Financial Officer Steven Weber sold 1,800 shares valued at over $3 million on August 9. At the same time, Executive Vice President Thomas Bowers offloaded 3,000 shares worth over $5 million on August 12.

Gottheimer’s trading activity

Elsewhere, a review of Gottheimer’s filings shows that the New Jersey politician is an active trader across various sectors, having made 2,874 trades as of July 31, 2024, with a trading volume of $279 million.

Additionally, Microsoft (NASDAQ: MSFT), Apple, and Alphabet (NASDAQ: GOOGL) are among the stocks Gottheimer has traded most frequently.

Rep. Josh Gottheimer’s stock trading activity. Source: Quiver Quantitative

In summary, there seems to be an increasing number of insider trading activities within the US Congress, highlighting possible conflicts of interest. As reported by Finbold, Senator Markwayne Mullin, who sits on the Senate Armed Services Committee, purchased defense giant Raytheon (NYSE: RTX) as of August 29. Since then, the equity has rallied over 70%.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

The post Monster Congress insider trading for this stock appeared first on Finbold.