Though Michael Burry is best known for taking skillful short positions – as exemplified by his role in the famous ‘Big Short’ during the Great Recession – his most-discussed current trade has been his investment in Alibaba (NYSE: BABA).

The two biggest drivers of interest for the BABA stock bet have been the sheer size of the position – the Chinese e-commerce giant became the top contender for the spot of the biggest holding in the portfolio during the previous quarter – and the fact that it has been teetering on the edge of profitability for over a year.

Still, as 2024 turned to September, Alibaba shares appear to have gained the potential to not only turn decisively green for Burry, but also provide the investor with massive returns.

Why Alibaba stock might soon skyrocket

After years of scrutiny over antitrust issues and allegations the e-commerce company was offering certain banking services without being licensed to operate as a bank, the Chinese government is reportedly finally pleased with Alibaba’s restructuring efforts.

According to the People’s Republic’s antitrust watchdog, Jack Ma’s firm has taken decisive steps to end its monopolistic practices, foster healthy competition in the industry, and improve conditions for sellers and customers, thus satisfying the probe, which started in 2020.

BABA shares turn green on the news

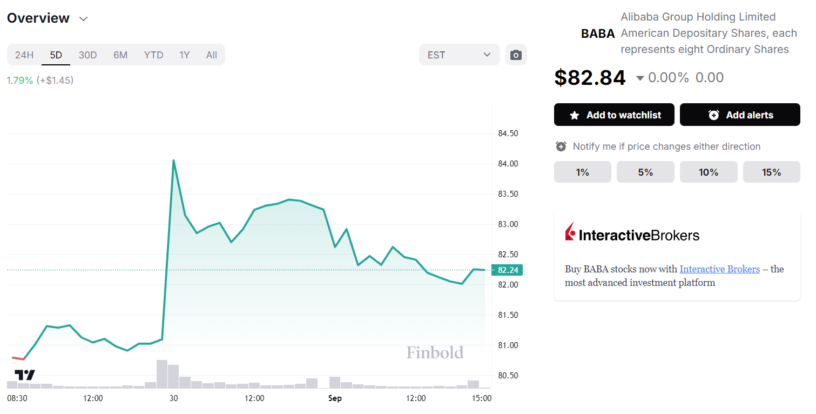

The news was immediately welcomed by investors, and on the morning of August 30 – the day the report was disseminated – BABA shares rocketed more than 4% to close to $85.

Despite the correction that came soon after, the stock continued trading higher in the subsequent hours and days and remains 1.79% in the green in the last five full market days. Alibaba’s price today stands at $82.84, 10.80% up in the year-to-date (YTD) chart.

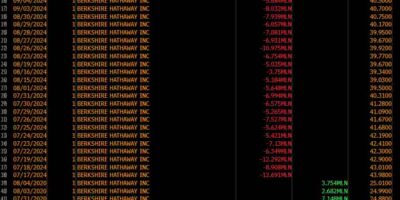

The positive developments are, however, yet to place Michael Burry decisively in profit on his BABA stock bet. Though the famous trader made multiple purchases of the stock in the last 14 months – some of which took place during the winter and spring downturns – the initial 70,000 shares are, at press time, most likely below the buying price of approximately $86.

Nonetheless, ‘The Big Short’ investor remained confident in Alibaba in the months before the Chinese antitrust watchdog’s decision, turning BABA into his largest holding at the time of the last 13-f filing, and is now likely to profit from this bullishness.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

The post Here’s why ‘Big Short’ M. Burry’s most controversial bet may soon pay off appeared first on Finbold.