Despite being backed by strong underlying fundamentals, Nvidia (NASDAQ: NVDA) has faced a notable short-term correction following the Labor Day holiday.

NVDA opened the September 3 trading session valued at $119, with the stock trading at $110, reflecting 24-hour losses of nearly 7%.

At one point, the stock recorded massive losses of about 12%, as escalating investor selling pressure wiped out almost $400 billion in market capitalization within three days. Indeed, the stock has been on a downward trajectory over the past week, losing more than 11%.

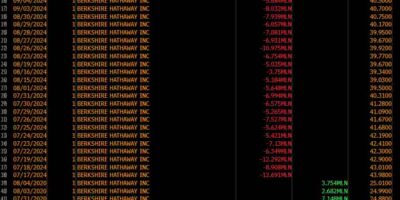

NVDA one-day price chart. Source: Google Finance

It’s worth noting that the current sell-off follows Nvidia’s Q2 2024 earnings report on August 28, where the tech giant surpassed analyst expectations. For instance, the company reported quarterly revenue of $30 billion, exceeding estimates of $28.72 billion.

Why NVDA is down

The sell-off is not isolated to Nvidia alone, as the broader markets have been sliding amid weak macroeconomic data. Nevertheless, Nvidia’s drop could be alarming, considering the company is viewed as one of the most important stocks due to its dominance in the artificial intelligence (AI) sector.

Indeed, Nvidia may have been impacted by traders’ activities, especially with many returning from the August holiday at the start of the month.

At the same time, the tech giant has been hit with new concerns regarding the state of the economy as critical data points to a grim picture. According to the Institute for Supply Management (ISM) data, the manufacturing PMI stood at 47.2 in August. However, these figures remained below 50, indicating contraction. Analysts view this data as less encouraging, dampening investor optimism.

Given Nvidia’s pivotal role in the stock market, concerns are mounting, especially if the equity fails to recover, considering September has historically been a challenging month for the market.

Investors will also closely monitor upcoming economic data to assess its impact on Nvidia’s valuation. Although inflation is perceived to be cooling, the potential for the Federal Reserve to cut interest rates will be worth watching, as will its impact on stocks such as Nvidia.

Analysts set Nvidia stock price

In the meantime, stock trading expert Peter DiCarlo previously warned that investors should anticipate significant drops in Nvidia’s stock price. In an X post on August 30, he observed that Nvidia had hit the “Dim Mak” or “death touch” on its stock, signaling a possible short-term top.

The recent price action suggests that the bullish momentum, which failed to surpass $130, has faltered, and the stock has entered a corrective phase.

NVDA stock price analysis chart. Source: TradingView

Despite hopes that institutional investors would support the stock, DiCarlo noted that Nvidia closed the week with lower lows, indicating a lack of buying support at these levels.

Consequently, the trader pointed out that, given the current sentiment, investors should watch for the $100 level, as it could present a buying opportunity.

Taking all factors into consideration, Nvidia needs to maintain its price above the $110 level, as this could potentially invalidate the bearish sentiment.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer:The content on this site should not be considered investment advice.Investing is speculative. When investing, your capital is at risk.

The post Why is Nvidia (NVDA) stock crashing? appeared first on Finbold.