For years, Tesla (NASDAQ: TSLA) has dominated the electric vehicle (EV) market, with the company’s stock ranking among the go-to options for investors seeking a stake in the industry.

However, in 2024, TSLA has been impacted by slowing demand and increased competition in the general EV market.

Overall, most companies in the space have the potential to offer high returns as EVs grow in popularity. Beyond Tesla, other players are providing alternative options for investors, with the potential to turn an investment of $100 into $1,000 in the coming year.

Nio (NYSE: NIO)

Nio (NYSE: NIO), the Chinese electric vehicle manufacturer, has been gaining traction due to factors such as an expanding vehicle lineup and improvements in battery technology.

Notably, the company’s strength was highlighted during its Q2 2024 results. Nio’s sales almost doubled year-over-year to nearly $2.4 billion, while net losses narrowed to $0.30 from $0.45 a year ago, driven by strong delivery growth.

In 2025, the stock could experience significant growth from sales driven by increasing demand for models such as the ES8. The EV maker is also expected to record higher sales volume as it focuses on the lower end of the luxury EV market.

For instance, it introduced the sub-brand Onvo in May, with the first model set to launch officially later in September. Onvo aims to promote mass consumption.

Additionally, the company plans to unveil the Firefly, a model that blends a small and compact SUV. This development will likely help NIO resume its delivery growth, which consistently surged in 2020 and 2021 before facing corrections in 2022 and 2023, mainly due to supply chain constraints.

While the company’s pipeline looks impressive, NIO faces several headwinds, including profitability challenges from expanding its battery-swapping networks, share dilution, and struggles with expansion into Europe.

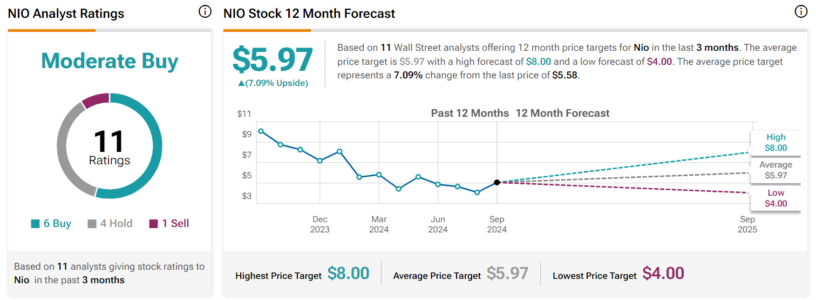

Meanwhile, 11 Wall Street analysts at TipRanks predict that NIO will likely gain over 8% in the next 12 months and trade at an average price of $5.97. Experts also suggest the stock could hit a high of $8, with the low forecast at $4.

NIO stock 12-month stock prediction. Source: TipRanks

At press time, NIO was trading at $5.58 with daily gains of over 1%. In 2024, the stock is down 33%.

NIO YTD stock price chart. Source: Finbold

Rivian (NASDAQ: RIVN)

Like other EV stocks, Rivian (NASDAQ: RIVN) has been attempting to recover in recent months after starting the year on a sluggish note. Investors are likely to build long-term interest in the company, considering its backing by giants such as Amazon (NASDAQ: AMZN).

Besides the strong backing, Rivian’s unique market position—focusing on the premium electric truck and SUV market with models like the R1T and R1S—is a niche market that could offer growth as more consumers seek sustainable alternatives.

Additionally, institutional investors have shown a preference for the stock. For instance, in the second quarter, 37 hedge funds held Rivian with a total stake of $383.6 million.

Based on these fundamentals, 22 Wall Street analysts maintain that RIVN will likely trade at an average price of $17 next year. This value reflects a growth of about 26% from the current valuation. The experts have also set a high price target of $30 and a low of $8.

RIVN stock 12-month stock prediction. Source: TipRanks

At press time, RIVN was trading at $13 with a 24-hour gain of 2.4%, while YTD’s stock is down 35%.

RIVN YTD stock price chart. Source: Finbold

In summary, with the growing competition in the EV market, the highlighted stocks offer an ideal alternative to Tesla. Indeed, based on their niche markets, both Rivian and NIO are likely to see strong upside potential.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

The post 2 Tesla rivals to turn $100 into $1,000 in 2025 appeared first on Finbold.